Payment Processing & Solutions

DealerShop has teamed up with a cost-reduction firm specializing in credit card processing fees, to provide you with a no-risk solution to remove significant wasted spend from your merchant account without switching processors or changing anything about your accounting system or point-of-sale. Let our proven audit process identify savings opportunities associated with the unnecessary costs from credit card transaction and processing fees.

Lower credit card processing fees without changing processors.

Most businesses are being overcharged within their merchant account. They often believe that there is only one way to achieve lower credit card processing fees: change processors. This is often a mistake. It’s typically best to stay with the processor you already have.

DealerShop and its Partners simplifies your existing merchant account.

Credit card processing fees are complex ON PURPOSE. The industry is made up of numerous banks, card-brands, and processors … and all of them influence the fees businesses pay. To lower these fees, you need extensive expertise, insider knowledge, and mountains of industry benchmark data. DealerShop has you covered. We will optimize your merchant account and fix every error and overcharge … without any need to change processors. And you don’t pay us a dime until we bring that money back to you.

Identifying the problem.

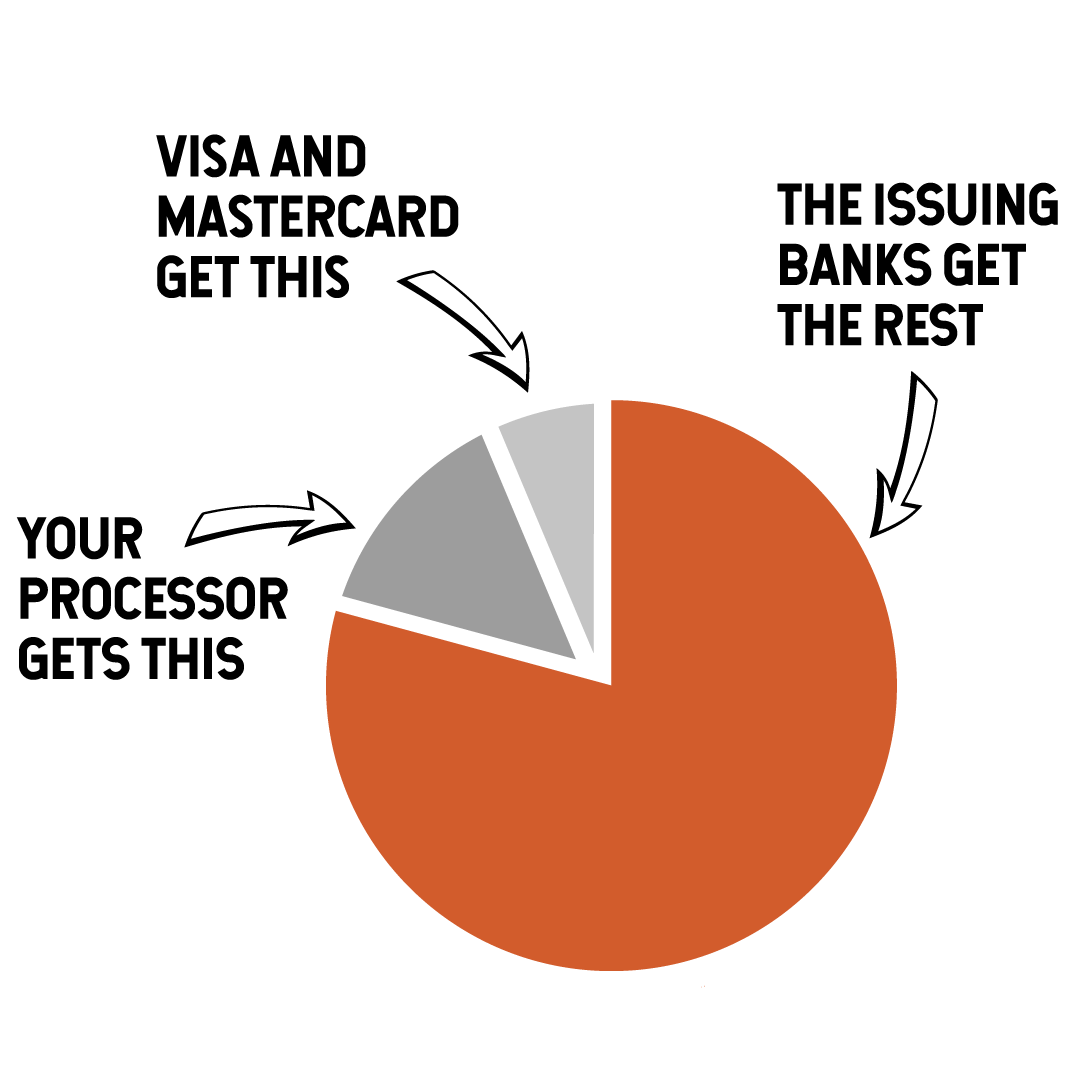

You have very little control over your merchant account credit card processing fees. Yes, you have a direct relationship with your merchant processor. But only a small amount of the credit card processing fees you pay go to that processor. Most go to the bank that issued the credit card … and you have no leverage with that bank. Most of their fees go to the bank that issued the credit card to your customer … and they have no leverage with that bank. These are called INTERCHANGE FEEs. And they can be lowered.

Processing fee optimization.

Many merchants recognize that they’re losing money on credit card processing fees, but they don’t have the expertise to identify where it’s happening or how to fix it. With our proprietary process:

- You get full transparency of your merchant processing fees

- Your account is optimized to the lowest possible rate

- You receive all applicable industry or card-type discounts

- We can even lower your interchange fees

- We do all of the work for you

A Better Way To Accept Payments.

Dealer Pay offers a wide variety of services to keep your business running efficiently. Our dealer-specific solutions cover more than just simple payment processing. We have innovative services to help you manage all facets of your dealership. From sales and accounting, to service and customer retention, Dealer Pay makes for happy employees and loyal customers!

Dealer Specific Solutions.

Our services are designed exclusively for dealerships and tailored to address the unique challenges they face. This means you can trust that our solutions are optimized to be the best possible fit for your dealership’s needs. Learn more at DealerPay.com

DMS Integrations

Our dealer-specific solutions are designed to help your dealership increase sales, profits, and process payments faster and more securely in each department. With DMS Integration, users can search in ‘real time’ for open RO#’s, parts tickets, deal numbers, and more. This integration reduces steps, minimizes errors, and ensures efficient transaction processing. Auto Reconciliation matches transactions to the DMS, highlighting any unmatched items for easy review and daily reports.